SVB fallout, inflation, and retail sales: What to know this week

Two key bits of economic data ahead of the Fed's next policy meeting will welcome investors into the coming week as the eyes of the investing public - and beyond - will remain closed to the latest developments in the fallout from last week's Silicon Valley collapse.

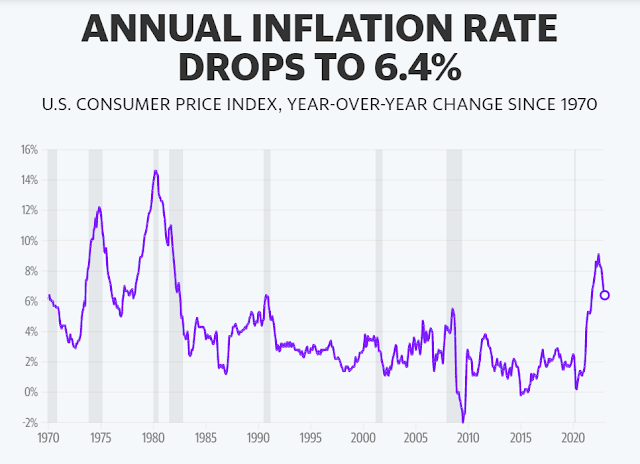

The February Consumer Price Index (CPI) on Tuesday and the February reading of retail sales on Wednesday morning will likely boost investors' expectations about the Fed's next policy move.

Consensus expectations are for CPI to rise 6% year-over-year on a headline basis and 5.5% on a "core" basis in February, according to data from Trading Economics. The 6% increase in inflation is expected to represent the slowest annual increase in consumer prices since September 2021.

Focused on the Fed's next steps in combating inflation, however, have been the biggest focus for investors recently with the sudden collapse of a Silicon Valley bank on Friday and concerns about what it could mean for the second-largest bank failure in US history, the broader financial system.

On Sunday evening, financial regulators said SVB depositors would have access to their funds from Monday, March 13.

In a joint statement, the heads of the Federal Reserve, Treasury Department, and FDIC said: "After receiving a recommendation from the FDIC Board of Directors and the Federal Reserve and consulting with the President, Secretary Yellen approved actions that enable the FDIC to complete its dissolution of Silicon Valley Bank, Santa Clara, Calif., in a way that fully protects all depositors. Depositors will have access to all their funds from Monday, March 13. The taxpayer."

US futures opened higher on Sunday evening.

As Yahoo Finance's Jennifer Schonberger reported on Friday, TD Coin analyst Jarrett Seberg wrote Friday that the company "doesn't see this as the beginning of a broader threat to the integrity and integrity of the banking system."

"Much like Silvergate (SI), Silicon Valley had a unique business model less reliant on retail deposits than traditional banks," Seberg added. "This left the bank more exposed to interest rate risk as its financing became more expensive, but its assets were not re-priced higher."

In a note to clients published on Friday, Kabir Caprihan, an analyst at JPMorgan, echoed many of those sentiments, writing: "At first, we don't think [the Silicon Valley bank collapse] is systemic, but it reflects some of the structural issues that we highlighted in our outlook and what Pay our lower weight on the regional banks."

The scale and particular challenges that brought down the Silicon Valley bank are unique -- its exposure to the cash-burning tech world that punishes investors during the Fed's rate hike campaign is at the top of this list. But the general story of a rise in deposits in 2021, outflows in recent months, and portfolio losses will likely challenge some regional banks in the near term.

Across the Atlantic, British Finance Minister Jeremy Hunt said the British government was working to ensure that any UK company facing cash needs from an SVB failure "can meet the cash flow requirements to pay its staff."

Semaphore reported over the weekend that hedge funds had approached cash-strapped startups in Silicon Valley with offers to buy their deposits at a discount, as some companies face a cash crunch as payrolls approach, and there is likely a long way to go to fully realize them on the money deposited with the failed bank.

Regulators are feeling buyers for Silicon Valley Bank and wealth management, investment, and securities under the bank's former parent company, SVB Financial (SIVB). Bloomberg reported Saturday that employees of the failed Silicon Valley bank would remain on the job for 45 days before being released.

"The circumstances of the Silicon Valley bank collapse are unique enough that they likely wouldn't lead to widespread financial contagion," wrote Paul Ashworth, chief North America economist at Capital Economics. "However, it is a timely reminder that when the Fed unilaterally focuses on squeezing inflation by raising interest rates - it often ends up breaking things."

Post a Comment