Mortgage rates continue to fall, making homeownership affordable for millions of Americans

Mortgage rates are dropping to the lowest level since mid-September. Freddie Mac says 3 million more people now qualify for a home loan.

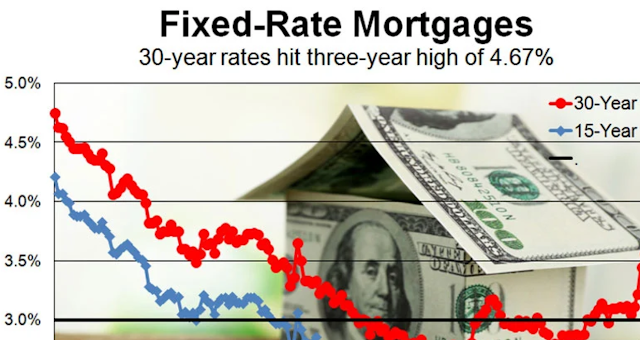

Freddie Mac said the average 30-year mortgage rate is 6.09% in his latest weekly Thursday survey.

The rates were 3.55% over the same period last year, compared to 6.09% today for 30 years.

The average 30-year fixed-rate mortgage was 6.09% as of February 2, according to data released by Freddie Mac on Thursday.

This is four basis points lower than the previous week - one basis point equals one-hundredth of a percentage point.

Last week, the '30s were at 6.13%. Last year, the 30-year average was 3.55%

Rates were at their lowest level since mid-September 2022.

The average 15-year mortgage rate has fallen to 5.14%.

Despite falling prices, the bleak economic climate gave homebuyers a reason to pause. According to a report from the Mortgage Bankers Association, mortgage demand fell 9% in the latest week.

What are they saying? "This one percentage point reduction in rates could allow up to 3 million more mortgage-ready consumers to qualify and afford a $400,000 loan, which is the average home price," said Sam Khater, chief economist at Freddie Mac statement.

Post a Comment